Cfo Company Vancouver - The Facts

Table of Contents3 Simple Techniques For Vancouver Accounting FirmGetting My Pivot Advantage Accounting And Advisory Inc. In Vancouver To WorkHow Tax Accountant In Vancouver, Bc can Save You Time, Stress, and Money.Things about Vancouver Accounting Firm

Not only will maintaining cool data and records assist you do your work more efficiently and also properly, however it will certainly likewise send a message to your company as well as clients that they can trust you to capably handle their monetary information with respect and also stability. Being mindful of the many tasks you carry your plate, understanding the target date for each, and also prioritizing your time as necessary will make you a significant possession to your employer.

Whether you keep a thorough schedule, set up regular pointers on your phone, or have an everyday to-do list, stay in fee of your schedule. Also if you choose to hide out with the numbers, there's no getting around the fact that you will certainly be required to communicate in a selection of methods with associates, managers, clients, and also sector professionals.

Also sending well-crafted e-mails is an essential skill. If this is not your strength, it might be well worth your time and initiative to obtain some training to boost your value to a possible employer. The accountancy field is one that experiences normal modification, whether it be in laws, tax codes, software program, or best methods.

You'll find out important assuming abilities to aid figure out the lasting objectives of an organization (and also develop strategies to achieve them). And you'll learn how to connect those strategies clearly and successfully. Review on to uncover what you'll be able do with a bookkeeping degree. tax accountant in Vancouver, BC. With many career alternatives to pick from, you could be stunned.

Pivot Advantage Accounting And Advisory Inc. In Vancouver Things To Know Before You Get This

Exactly how a lot do accountants and accounting professionals charge for their solutions? Exactly how a lot do accountants and accounting professionals charge for their solutions?

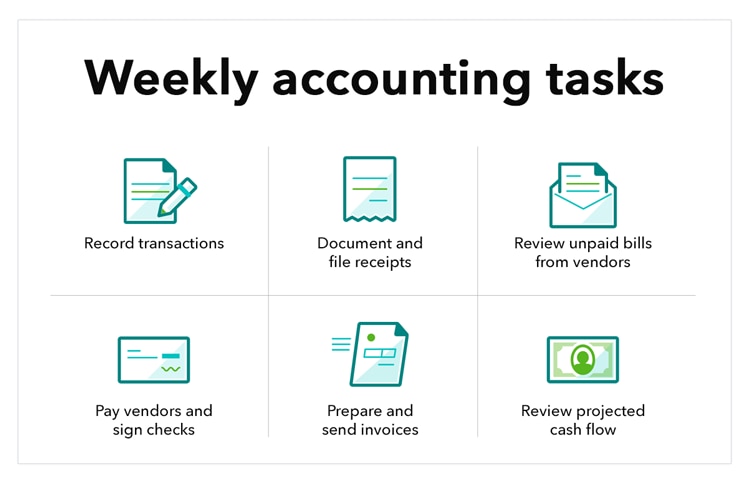

To comprehend pricing, it's practical to recognize the difference in between bookkeeping as well as bookkeeping. These 2 terms are typically used mutually, yet there is a considerable difference between bookkeeping and audit services. We have actually written in information about, however the really fundamental feature of an accountant is to tape the transactions of an organization in a consistent method.

:max_bytes(150000):strip_icc()/Accountingpolicies_color-6c5485e2b09541c697abd98d3094534c.png)

Under the traditional technique, you won't understand the quantity of your costs until the job is total and the company has accumulated all of the mins spent dealing with your data. This is an usual pricing technique, we find a pair of things wrong with it: - It produces a scenario where customers really feel that they should not ask inquiries or learn from their accountants as well as accountants since they will be on the clock as quickly as the phone is answered.

The 6-Minute Rule for Pivot Advantage Accounting And Advisory Inc. In Vancouver

If you're not pleased after completing the program, simply reach out and also we'll offer a full reimbursement with no questions asked. Now that we have actually clarified why we don't like the standard version, allow's look at how we value our solutions at Avalon.

we can be available to aid with bookkeeping and also accountancy inquiries throughout the year. - we prepare your year-end financial declarations and tax return (CFO company Vancouver). - we're here to assist with concerns as well as guidance as needed Systems configuration and one-on-one accounting training - Yearly year-end tax filings - Assistance with questions as needed - We see a great deal of local business that have annual income between $200k and $350k, that have 1 or 2 employees and are proprietor handled.

- we set up your cloud audit system and teach you exactly how to submit records electronically and also check out records. - we cover the price of the accounting software application.

Not known Facts About Tax Consultant Vancouver

We're additionally readily available to address inquiries as they turn up. $1,500 for accounting and also payroll systems setup (single expense)From $800 per month (includes software application fees and year-end expenses billed month-to-month) As organizations expand, there is typically an in-between size where they are not yet huge enough to have their very own inner financing division yet are made complex enough that simply working with an accountant on Craigslist won't suffice.